Better nutrition is the key ingredient for growth in 2024

Leverage labels that offer improved nutrition to drive preference and more consumer value on the shelf

While deliciousness is always the primary driver of choice, consumer expectations for food and beverage products are growing and changing the competitive landscape of many categories. Despite increased prices and inflation, there is an opportunity to overcome price sensitivity by offering products with consumer-preferred benefits that increase perceived value. The right (re)formulation and strategic labelling can drive pricing resilience. In the post-COVID age where consumers are more heavily focused on nutrition and making healthier food choices, winning products are those that taste delicious AND offer increased value by including the most in-demand nutrition, health and wellness benefits. We understand the complexity of that challenge, which is why we’ve created a process to help our customers Own the ANDSM of delectability AND better nutrition.

On-pack messaging is a go-to source for consumers who are keen to know about health and nutritional value of a product.

1 in 2 consumers globally look to on-pack claims to determine the nutrition, health and wellness value of food and beverage products.

Ingredient lists and nutrition labels are the top sources after claims.

Source: Innova1

And though “better” nutrition can be subjective, the point remains that consumers value brands and products that help them take a step — however big or small — towards living healthier lives. That means they’re reading labels and comparing nutrition claims side-by-side in the supermarket aisle.

Three ways to shift purchase dynamics: the critical moment at the shelf

1. First impression

Front-of-pack claims are the primary lens through which consumers view a product’s core offering, positioning and benefits.

2. Consumers ask, “What’s in it for me?”

The relative differences in the nutrition panel between product offerings in the same category can drive significant changes in purchase behaviour. Added grams of protein and fibre, reduced levels of sugar, sodium and different types of fat are key decision drivers for nutrition-savvy consumers leading a variety of lifestyles.

3. Keeping it clean and simple

Ingredient lists also offer a number of opportunities to influence the purchase decision. Some seek organic, some seek clean label and others are looking to avoid specific “trigger” ingredients. Many major food and beverage brands have built their business and driven market share with clean label ingredient panels and minimal ingredients.

45% of global consumers cited “eating a healthy and nutritious” diet as the top way to achieve their objectives in living more healthy lifestyles.

Source: Innova1

Consumers are doing this by:

- Seeking natural foods with inherent nutrition

- Choosing clean label products that avoid additives and artificials

- Boosting nutrition with functional and fortified products

- Limiting “bad for me” ingredients1

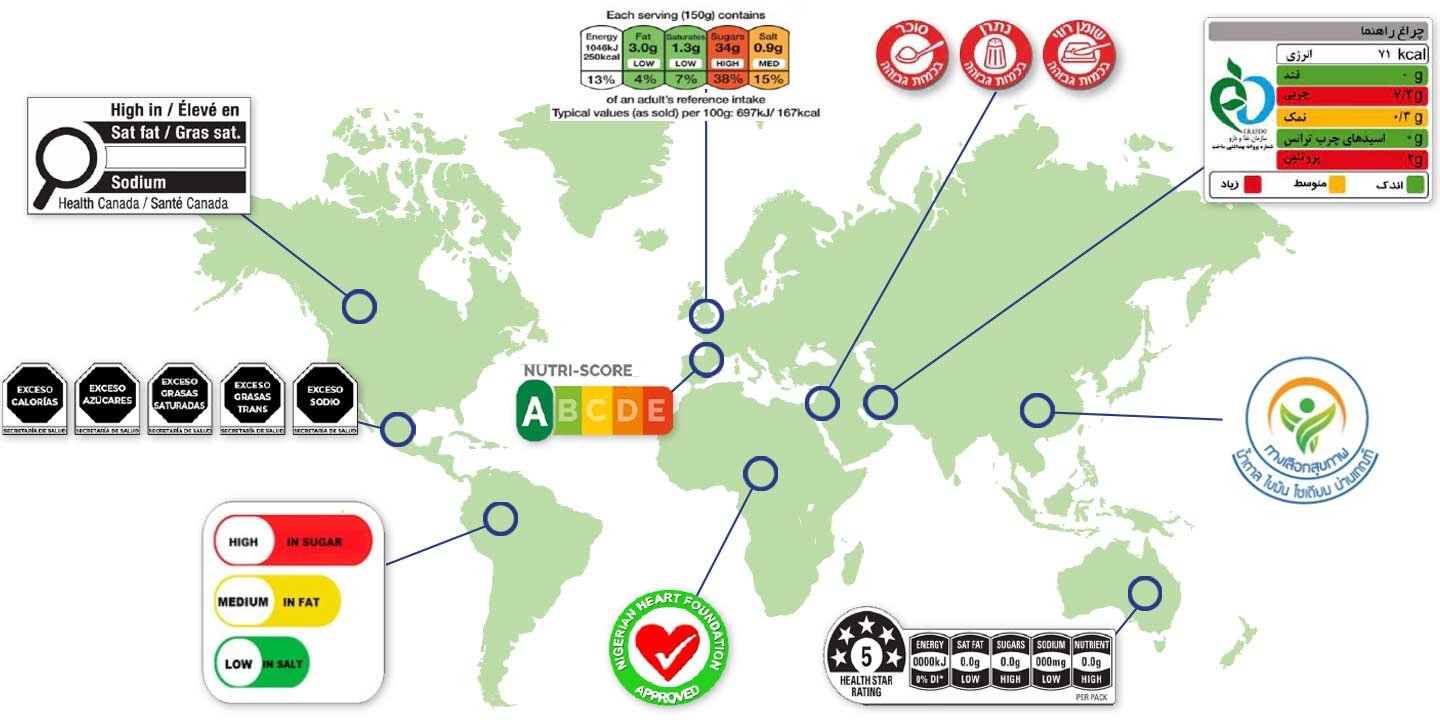

Aside from developing products in line with increasing consumer preference for nutrition and value, regulatory pressures also provide the impetus for reformulation. Government and industry standards aim to improve public health and consumer education through updated on-package labelling requirements and nutritional recommendations.

And while specific standards and regulations vary from country to country, they’re all moving in the same general direction with an emphasis on transparency and substantively improved nutrition. The manufacturers who are proactive in developing products and changing their associated front-of-pack and nutritional labelling to better align with forthcoming regulations will have a unique advantage in promoting the benefits that help consumers feel like they’re getting the value they need for the money they spend.

Below are examples of recent packaging requirements driving formulation updates in different parts of the world. Our global organisation can support your team in linking the most desirable consumer benefits to the industry-recognised definitions of nutrition, health and wellness and help adapt formulations for regional execution that meet local regulatory requirements.

New packaging requirements motivate formulation updates

Source: Ingredion Proprietary Manufacturer Research, 2023

Build your business and brand equity with (re)formulation strategies that drive product superiority and consumer preference.

For food and beverage manufacturers who want to fuel their product improvement pipeline, they need a partner who can develop reformulation strategies that maximise consumer preference, advance product superiority relative to the competition and manage regulatory risk on the horizon. Delivering more value and driving significant growth in the market is there for the taking, but the key is to know exactly what those consumer preferences are and develop products that meet increasing nutritional expectations AND hit the mark for deliciousness sure to drive repeat purchase. It is possible to provide new features and benefits AND the familiar eating experience offered by your brand’s signature flavour and that just right texture.

E-book: The power of the label

Meaningful claims with improved nutrition and ingredients can help your brand drive consumer preference and increase price resilience.

Discover how our expertise and proprietary insights can show you how to:

- Identify high-value opportunities

- (Re)formulate for impactful labeling

- Deliver delicious products that win at the shelf

That's where a strategic, value-adding partner like Ingredion comes in. With our global ATLAS database, we help our customers identify the actionable consumer-driven food and beverage trends that can energise categories and strengthen consumers’ willingness to pay more. ATLAS is the largest proprietary global research program examining consumer trends, including attitudes and behaviours towards key ingredients and benefits within the food and beverage industry. ATLAS enables us to uncover more consumer value — both demand and pricing power. The scale of the survey allows us to understand the impact of different benefit combinations by region, category and ingredient. For example, we can help our customers discern the business value of increased protein and reduced sugar in yoghurt for specific Asian and European markets.

In addition to our consumer and market insights, we help create innovative solutions and add more consumer value with our extensive formulation experience and comprehensive portfolio of on-trend, consumer-preferred ingredients commonly associated with nutrition, health and wellness.

Partner with us to create more consumer value in these key trends

Key trend: Nutrition

The scientific discipline concerned with the access and utilisation of food and nutrients as a fundamental pillar for life, health, growth, development and wellbeing.

Ingredion's solutions to enhance nutrition

- Fibre

- Protein

- Sugar reduction

- Fat reduction

- Sodium reduction

- Calorie reduction

- Net carb reduction

Source: World Health Organisation

Key trend: Health

A state of complete physical, mental and social wellbeing and not merely the absence of disease or infirmity.

Delivery of ingredients for total health

- Digestive health

- Metabolic management

Source: World Health Organisation

Key trend: Wellness

The active pursuit of activities, choices and lifestyles leading to a holistic state of health.

Enablement of wellness lifestyle choices

- Sustainable

- Ethical

- Traceable

- Clean label

- Plant-based

- Non-GMO

- Organic

- Gluten-free

Source: Global Wellness Institute

Formulate for incremental nutrition improvement.

The road for consumers to live healthier lifestyles is paved with small, incremental steps towards their goals. They look to manufacturers to offer products that add more of a beneficial ingredient, such as added protein or fibre, or to formulate with less of something, like fewer grams of sugar, salt and fat, and by removing anything artificial, including flavours and colours. Increasingly, they want to see ingredient lists become simpler and more transparent with a more clean label approach, but not at the expense of taste.

The same incremental approach applies to (re)formulation activities as well. Consumers are sensitive to big changes all at once, but the cumulative effect of smaller, iterative formulation adjustments over time allows manufacturers to build a pipeline of value-added product improvements while meticulously maintaining or improving preferred, proprietary taste profiles at the core of their brand’s success. These changes can include creating offerings with more natural ingredients with inherent nutritional advantages or substituting, reducing or even eliminating ingredients consumers actively seek to avoid, all while communicating those changes on the packaging. And, of course, the move to clean label products bolstered by functional and fortified ingredients is a top priority in today’s reformulation trends.

Manufacturers are prioritising the following ingredient-based (re)formulation efforts

- High protein

- Clean Label

- Sugar reduction

- Indulgence

- Health claims and benefits

Source: Ingredion food and beverage manufacturer study3

In our 2023 manufacturer study, food and beverage producers reported a significant increase in changing consumer preferences and retailer requests driving reformulation compared to our previous research in 2021. The ability to efficiently adapt to consumer demands for better nutrition with value-added benefits is an important factor in capturing additional market share and improving the bottom line.

Nearly 7 out of 10 consumers are willing to pay more for recognisable ingredients.

Undoubtedly, the shift to better nutrition offerings begins with ingredients that can provide the value consumers seek, and our ATLAS study shows they are willing to pay more for that added value.2

When consumers were asked which ingredients or claims are the most interesting/appealing and worth paying more for, “naturalness,” “clean label and nothing artificial” rank superior to other options.2

That’s why manufacturers are prioritising higher-quality ingredients as they look to provide options that appeal to a growing number of consumers checking labels and nutrition panels in search for better nutrition through foods and beverages.

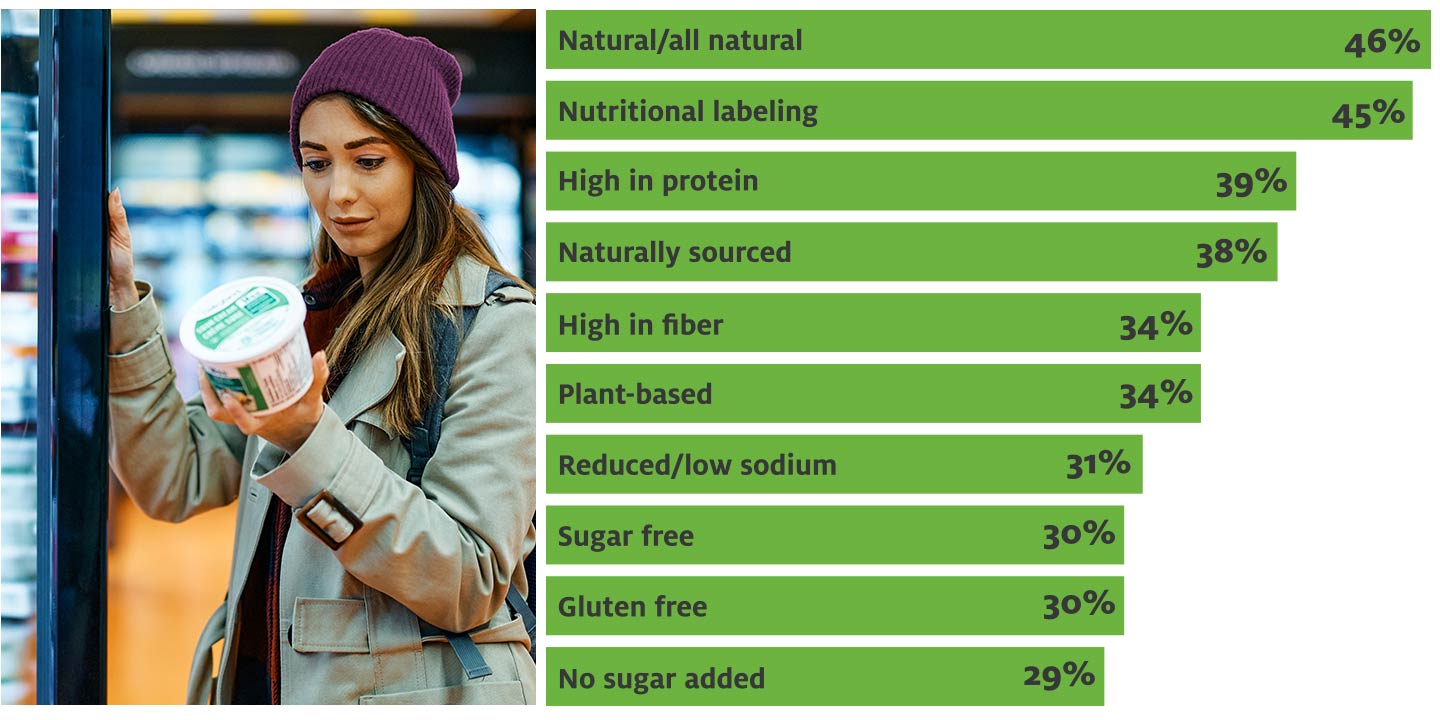

Top 10 packaging claims food and beverage manufacturers are prioritising

Source: Ingredion Proprietary Manufacturer Research, 2023

Clean label, in particular, is important for manufacturers and consumers alike as it gives brands a means to reformulate for the benefits consumers want, which drives increased appeal and brand loyalty. While manufacturers continually improve their labels for a variety of reasons, aligning with consumer preferences for clean label can result in a more positive brand reputation and increased profits as products are perceived to be of higher quality.

Increase product appeal with clean label ingredients

Ready to deliver simpler, cleaner products made from ingredients that are understood, expected and consumer-preferred? Download our Powering Profit report to learn about:

- How clean labels can power profit for manufacturers

- Defining clean labels and consumer perceptions of health and wellness

- How Ingredion can break down barriers for clean label adoption

Overcome your nutrition (re)formulation challenges

Critical to delivering share-winning products is the ability to formulate with the satisfying taste your consumers expect AND the right combination of enhanced nutrition benefits to meet their needs, but balancing what consumers want with delivering cost-effective products can be challenging.

Ingredion has the ingredient and application expertise to enable new formulation or reformulation that delivers on consumer-preferred nutrition, health and wellness claims AND an exceptional eating experience. Grounded in leading-edge science, we can help you dial in formulas that offer the right mix of product features and benefits that appeal to more consumers AND satisfy their multiplying needs while maintaining great taste. It’s a concept we call Own the ANDSM, but it’s not about having all the ANDs; it’s about formulating for the right ANDs to put your brand in the best possible position for accelerated growth.

Webinar: Better Nutrition by Design – Crafting Snacks for Discerning Customers

How can your brand better align with consumer snacking preferences? Listen in as our expert panel discusses:

- Consumer trends and insights on improving nutrition in snacking segment

- The growth opportunity brands can capture by delivering consumer-preferred snacks

- Innovative sugar-reduction techniques and ingredients that can enhance the nutritional profile of snacks without compromising taste and texture

Meet consumer demands with functional and fortified ingredients

A trend gaining momentum for food and beverage manufacturers stems from the idea of positive nutrition — adding something to make a product better for you — with high-quality, functional and fortified ingredients. In pursuit of value for their money, consumers want food and beverages to do more for them by offering an increasing number of benefits, and it’s a call to action for manufacturers looking to increase brand appeal and accelerate growth.

Ingredion has the portfolio and know-how to zero in on consumer demands for positive nutrition, functional and fortified ingredient integration and much more, including:

Cleaner-tasting protein

Advance nutrition formulation with better-tasting Ultra-performance pulse proteins and flours.

Fibre enrichment

Support digestive health with our soluble and insoluble fibre ingredients.

Functional protein enrichment

Formulate for in-demand protein and nutrition while offering the functionality you need with our VITESSENCE® pulse pea protein isolates.

Sugar reduction

Innovate with winning formulations that offer sweet taste and full functionality with less sugar.

Fat reduction

Deliver clean and simple labels, solutions for reduced fat and better nutrition with our functional native and modified starches.

Sodium reduction

Magnify salty notes while reducing sodium with Ingredion’s range of flavours with modifying properties.

Your guide to better nutrition, health and wellness ingredients

Capture consumer demand for healthier food and beverages with the right combination of features without sacrificing taste. Ingredion experts can help you delight customers while differentiating your brand from the competition.

Innovate delicious, healthier products with clean label NOVATION® Indulge starches

NOVATION® Indulge co-texturising starches enhance the texture and mouthfeel in foods to increase indulgence, improve quality and drive revenue. These starches enable shorter ingredient statements when used in conjunction with other starches to create a simple ingredient list and support today’s reduced sugar, low-fat and dairy-free trends.

Put your (re)formulation strategy into action

Our extensive and versatile ingredient portfolio combined with our technical expertise can help you develop consumer-preferred products that stand out among the competition in your category. Some examples include:

Ingredion's food and beverage expertise — how Ingredion can help

Our knowledge of the global food industry ensures the ideas we co-create meet consumer demands and are actionable, viable solutions for our customers that maximise deliciousness AND take into account the multitude of factors consumers want for better nutrition AND the manufacturing attributes our customers need. Regardless of your category, Ingredion can provide the ingredients, insights and application-specific formulation expertise to help you create products that meet and exceed consumer expectations for better nutrition.

Ingredion has the people, proficiency and passion to help you anticipate what’s next and succeed. We collaborate with you to drive growth and bring your vision to life. With our deep understanding of consumer nutrition preferences, we are here as your indispensable partner to help you Own the AND℠ — and always be what’s next™.

We can help you deliver the added value consumers demand

Ingredion’s cross-functional team of experts makes it possible for you to create food and beverages with the right combination of consumer-preferred benefits AND the taste and experience they desire.

1Innova Lifestyle & Attitudes Survey, 2022

2ATLAS, Ingredion Proprietary Consumer Research, 2023

3Ingredion Proprietary Manufacturer Research, 2023