Maximise brand value by formulating to 2024 consumer food preferences

Delivering the right combination of benefits can grow dollar share and brand loyalty

The road to success in creating deliciously appealing food and beverages is paved with a growing number of obstacles that manufacturers must navigate and overcome. Formulating for quickly evolving consumer needs is tricky enough, but when you add supply challenges and increasing inflation to the mix, finding the right solutions can be daunting.

Addressing factors influencing food and beverage choices

Ingredion recognises the challenges our customers face and the evolving expectations of their consumers. That’s why we work closely with them to develop food and beverage solutions are not only delicious but also deliver on consumer preferences and manufacturing demands — all while discovering new opportunities for growth to help them be what’s next™.

75% of consumers are being more deliberate in assessing products and are trying to make better choices when purchasing food and beverages.*

The changing value equation: despite inflation, consumers are willing to pay more for brands that share their ideals and expectations for “better”

Though individuals may have vastly different motivations contributing to how they choose what to eat and drink, the data reveals that beyond the taste they love, people make purchasing decisions based on a growing number of other factors — ranging from functional nutrition to personal values and lifestyle choices — and they’re willing to pay more for what matters most to them.

In this article:

Take a closer look at our latest proprietary ATLAS study2 that informs the consumer value equation, and explore how these learnings play a role in finding growth potential with specific claims:

- Top 10 claims impacting purchase decisions

- Top 5 drivers of choice globally and by region

- Claims consumers are willing to pay more for

- Insights specific to clean label, sugar reduction and nutrition, health and wellness

- How Ingredion can help your company use this data to win

The insights from the ATLAS survey serve as a perfect starting point as manufacturers evaluate their formulations and seek new ways to incorporate additional benefits, such as clean label ingredients, reduced sugar, added fiber, sustainable farming and a wealth of others that can tip the competitive scale for a consumer comparing products in the supermarket aisle.

Put Ingredion’s exclusive and comprehensive consumer research to work

Ingredion uses our global ATLAS database to help our customers uncover the latest consumer-driven food and beverage trends that can energise categories and increase consumers’ willingness to pay more. ATLAS is the largest proprietary global research program examining consumer trends, including attitudes and behaviours towards key ingredients and benefits within the food and beverage industry. The program spans more than 10 years, 33+ global markets and 100,000+ consumer interviews.

What’s most exciting for our customers is the scale of the data in each survey allows us to drill down by region, category and ingredient. So, for example, we can help our customers understand how the desire for increased fiber is affecting noodle trends in Asia or bakery products in Europe.

LinkedIn Live: Maximise brand value by meeting evolving consumer needs

Our expert panel discuesses:

- The tools and techniques needed to solve for the consumer value equation

- Trends and proprietary insights that can help brands add value for their target consumers

- Real-world examples that illustrate how we help our customers apply these learnings

Ingredion’s conjoint analysis allows us to determine the best mix of features and benefits for a given category and region that maximise opportunities for growth by illustrating changes in purchase intent at a variety of price points.

Our skilled, cross-functional teams turn concepts into reality. Our expertise in speciality ingredients, nutrition and sensory science, sustainable farming practices and advanced production processes enables our partners to quickly discern the best choices for building their business.

Top 10 claims consumers look for when purchasing food and beverages

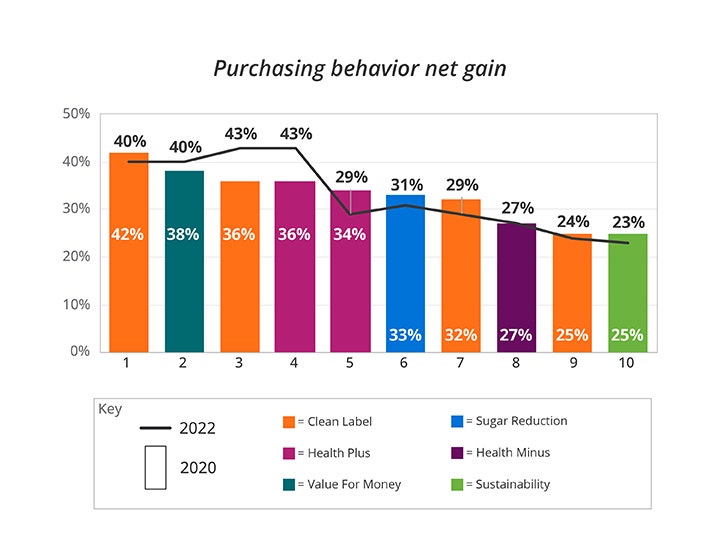

Increasingly, consumers are considering claims on food and beverage packaging and being more mindful of ingredient lists and nutritional information before making a purchase. Statements highlighting clean label, added health benefits and sugar reduction continue to be important drivers of consumer selection and purchase intent.

However, the most dramatic, statistically significant increase reported in this year's study is that consumers are checking ingredient and nutrition labels, both reported at 43%, up from 36% in our prior study.

Percentage net gain of packaged food and beverage purchasing behaviour 2022 vs. 2020

Top 10 purchasing behaviours

- Clean label / natural ingredients

- Looking for sales / lower prices

- Checking ingredient labels

- Checking nutritional labels

- Health claims such as digestive health

- Reduced sugar or no added sugar

- No additives or artificial ingredients

- Reduced or zero fat claims

- Organic products

- Sustainability or environmental claims

Source: ATLAS 2023

Top 5 drivers of global food choices in 2024

What are the top factors that influence food and beverage purchase decisions globally?

- Brand

- Ingredient list

- Ingredient claims

- Nutritional information

- Health claims

Many different factors are in play as consumers make their food and beverage choices. Globally, brand ingredient lists, ingredient claims, nutritional information and health claims rank as the top-five most important factors. While there are some differences between regions, it is clear that despite inflation, factors such as improving ingredients and nutritional benefits are growing in both global and regional importance. The brand name is still a major influencer in product selection, but several other considerations are now carrying more weight as consumers make their food and beverage choices.

Most and least important on-pack information influencing packaged food and beverage purchases

Source: ATLAS 2023

Source: ATLAS 2023

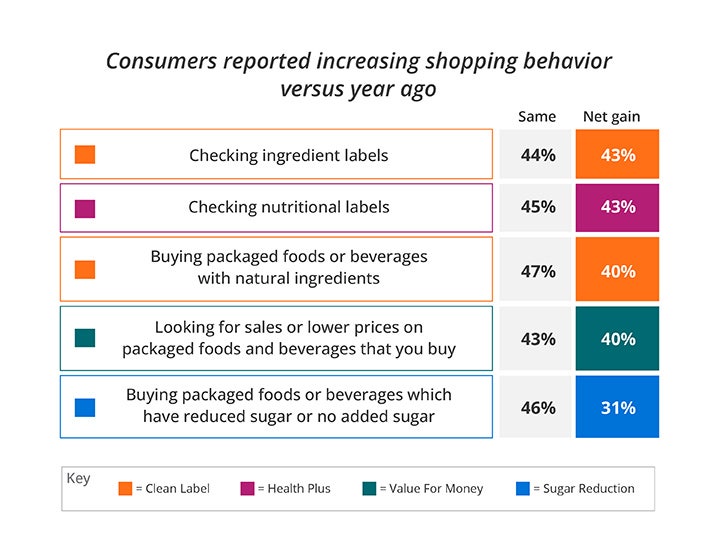

Consumers seeking more value-add benefits report scrutinising ingredient and nutrition labels more than before

Respondents of the ATLAS survey self-report that they have increased their activity in a number of areas when seeking “better” food and beverage alternatives. As consumers pay special attention to how they spend their money, they are looking to identify the best added-value options and increasingly checking product details to ensure that their preferences and needs are being met by the products they eventually decide to buy.

Consumers are looking to identify the best added-value options and increasingly checking product details

Clean label, health plus – or the inclusion of health benefits – and sugar reduction have seen the strongest net gain in consumer buying behavior over the past year. Consumers are also checking perceived value for money through sales.

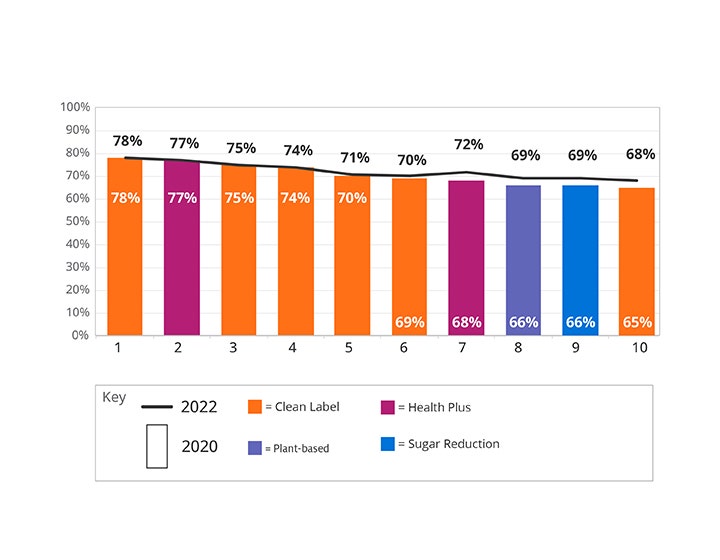

Benefits for which consumers are willing to pay more has remained consistent

From all-natural to non-GMO, high protein to reduced sugar and more, data shows that consumers will continue to pay a premium for the product attributes that matter most to them.

Percentage of consumers who would pay more for food and beverage claims in 2022 vs. 2020

Top 10 claims consumers will pay more for:

- Natural / all natural

- Offers health benefits such as digestive health and immunity

- Organic

- No artificial ingredients

- No additives / E-numbers

- Non-GMO

- High protein

- Made with plant based ingredients

- No sugar or no added sugar

- Contains only recognisable ingredients

Source: ATLAS 2023

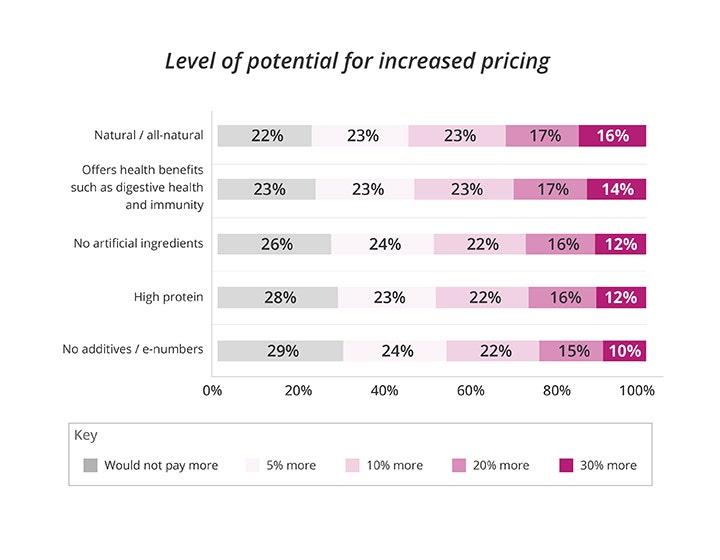

How much more will consumers pay for all-natural products?

Seventy-eight percent (78%) of consumers say they would pay more for products listed as all-natural, and taking it a step further, 56% would be willing to pay 10-30% more and 33% are willing to spend 20-30% more for all-natural products. Additionally, five of the top-six claims are in the clean label, all-natural, no artificial ingredients benefits space.

Percentage of consumers willing to pay more for benefits

33% of consumers are willing to pay +20% or more for all-natural claims

Source: ATLAS 2023

Consumers especially attuned to all-natural food trends are willing to pay more across the board

Additionally, those who are willing to pay more for specific claims place more importance on all label and ingredient claims overall and are willing to pay more on average for a variety of product attributes.

Demographic trends indicate household age is a larger influence than income

Demographic variables also show trends in consumers’ willingness to spend more on products with the features and benefits they find most important. Surprisingly, desire for better food and beverage choices is not driven by escalating income. It’s driven more intensely by younger households. Consumers 18-34, and/or those with children, are primarily the ones who will pay more for added features and benefits. For example, females with children are the most likely to spend more for products with reduced- or no-sugar claims.1

Food and beverage manufacturers seeking growth must understand what consumers are willing to pay more for and calibrate their product offerings based on that knowledge as well as regional and demographic preferences and expectations.

Category-specific consumer preferences that can draw big returns

The appeal of clean label shows no sign of slowing down

Consumers continue to place a high level of importance on clean and simple ingredients. In fact, the latest data shows that clean label factors motivate consumers to pay more, with 78% stating they would spend more money on products with packaging claims stating “natural” or “all-natural.” Consumers also value simplicity in their product ingredients. Sixty-eight percent (68%) stated they will pay more for products that contain only recognisable ingredients.

Additionally, consumers are looking at ingredient labels 43% more than they were just three years ago. Other consumer purchasing behaviour growth trends we see include:

- Natural ingredients (+40%)

- No additives or artificial ingredients (+29%)

- Organic products (+24%)

Create momentum in clean label

Ingredion's comprehensive range of clean label ingredient solutions provides many options to replace what consumers perceive as undesirable ingredients and develop new products with shorter lists of consumer-preferred and easily recognised ingredients.

Two-thirds of consumers are willing to pay more for reduced-sugar offerings

Without question, consumers today want to limit their consumption of sugar. Around the world, sales of packaged food and beverage products with reduced-sugar claims have grown by more than 30% since 2020.

Interestingly, on-package claims of “No added sugar,” “Reduced sugar” and “Contains zero sugar” are equally motivating among two-thirds of consumers. That’s particularly relevant to manufacturers as it suggests they can still succeed with formulations containing less sugar rather than no sugar, which makes it easier to maintain the brand’s familiar taste.1

Not only are they choosing products with reduced sugar or alternative sweeteners at a greater clip, consumers are also willing to spend more for them. The ATLAS study shows that two-thirds of respondents said they will pay more for food and beverage products that help them achieve their goals related to their sugar intake.

Develop great-tasting products without all the sugar

Ingredion has the applications know-how and a comprehensive portfolio of sugar alternatives that allows manufacturers to create market-winning reduced-sugar and no-sugar-added products quickly — and with just-right taste, texture and label appeal.

Improving nutrition and health benefits can help manufacturers maximise value

The nutrition, health and wellness space covers a lot of ground. It, of course, relates to physical well-being with the foods and beverages we use to fuel and nourish our bodies. However, it also pertains to mental and emotional well-being and lifestyle choices, such as choosing products for their sustainability or fair-trade practices.

According to the ATLAS study, nutrition or health benefits show the greatest opportunity for consumers to accept higher prices. For example, as the world becomes more educated on the benefits of fiber and gut health, products higher in fiber have drawn considerable attention.1

Deliver nutrition, health & wellness benefits that consumers want

Ingredion has options to satisfy the most in-demand nutrition, health and wellness label claims.

We create solutions for cleaner, more sustainable food and beverages with ideal taste, texture and functionality.

To further illustrate the appeal, data shows that 75% of respondents said they would pay more for products offering “health benefits such as digestive health and immunity” and “high protein.”

Regardless of individual lifestyle needs, nearly all consumers expect manufacturers to continually improve their products, making them better for both people and the planet.2

Ingredion’s plant proteins recognised for sustainability excellence

Our ultra-performance line of plant-based protein solutions has been named the Best Plant-Based Sustainability winner during the 2022 World Plant-Based Awards. This better-tasting, more sustainable product line provides great versatility in a variety of applications.

Accelerate your brand’s growth with Ingredion

Most people care about what they eat and are trying to make better choices. The research is clear that they are willing to pay more for claims that support their lifestyle objectives and eating preferences. However, not all benefit areas or claims carry the same level of interest, and patterns may differ by region or culture or demographics.

The overall trends, however, are unmistakable. Consuming food and beverages to improve health and well-being is an investment most consumers are willing to make, and unlike many other trends we’ve seen in the past, this behaviour has become a movement, and it’s here to stay.

Deliver taste AND nutrition AND sustainability

Whether you’re trying to simplify labels, ensure products are delicious or help consumers make healthier choices, Ingredion has the ingredients and expertise to help.

Formulating for nutrition

Boost nutrition benefits and win over health-conscious consumers with ingredients from Ingredion. Learn more about our capabilities in formulating for better nutrition.

Formulating for health

Create food and beverages for digestive health and metabolic management with our healthy ingredients and expertise. Formulate for health with the experts at Ingredion.

Formulating for wellness

Formulate for wellness with Ingredion’s expert solutions. Examine insights and discover ingredients that add value for consumers and your bottom line.

Sustainability

From our portfolio of sustainable ingredients to our 2030 All Life plan, see how Ingredion is bringing the potential of people, nature and technology together.

Inflation: Hidden Cost or Opportunity?

How product priorities are balanced today can have a long-term impact on your competitive positioning and brand equity in the future.

Our expertise

Ingredion has the expertise and insights to help you anticipate and deliver what’s next. Our expertise in sugar reduction, clean label and more can help.

Own the AND℠ to develop the future of food

Partner with Ingredion experts for solutions to your toughest formulation and innovation challenges. We can help you create more consumer value and gain share in today's rapidly evolving market.

* Source: Health & Wellness 2021: Reimagining Well-being Amid COVID-19. Hartman Group. https://www.hartman-group.com/reports/37787061/health-wellness-reimagining-well-being-amid-covid-19

1 ATLAS Proprietary Study 2023

2 ATLAS Proprietary Study 2020